How the New NDIS Funding Periods Work (and what it means for you)

[Image Description: A woman wearing red holds a yellow piggy bank, looking at coins on a table in front of her.]

If you’ve been around the NDIS for a while, you’ll know that change is part of the deal. But the latest update to how your funding is structured landed with little warning and a lot of confusion.

Back in October 2024, all new and reassessed plans started including funding components and funding periods. But since plans were still locked into 12 month cycles, not much really changed.

Now, from 19 May 2025, things are shifting again. Plans can include short and mixed funding periods, meaning your funding might be released in stages and on different timelines depending on the type of support.

The goal is to give people more structure and reduce the risk of over or underspending. But let’s be honest, it also makes budgeting a whole lot more complex, especially if your support needs change from time to time.

Understanding how this all works is going to be key, so we’ve broken all the changes down for you. Whether you’re managing your own plan, supporting a family member, or just trying to stay informed, this guide will help you understand what’s changing, why it matters, and what you can do to stay on track.

Understanding the Total Budget Amount

Your plan will include a total budget amount, which is the full amount of funding the NDIS has approved in your plan. Essentially, this is the total pool of money you have to work with for all your reasonable and necessary supports.

The NDIA calculates your total budget based on the types of supports you need, how often you need them, their cost (based on the NDIS price guide), and whether you share supports with someone else.

Once they’ve worked that out, they add it all up to create your total budget. You’ll see this number at the top of your plan and in your plan approval letter.

Knowing your total budget helps you understand the overall scale of your plan. But it’s not one big flexible pot. Instead, it’s broken down into funding components (which we’ll get to next), and each of those has its own rules.

What Are Funding Components?

A funding component is a portion of your total budget that’s been allocated for a particular purpose. For example:

You might have a component for core supports - things like help with daily living, transport, or consumables.

Another component might be for capacity building - like therapy, skill development, or employment support.

You could also have a component for something very specific, like assistive technology (say, a power wheelchair), or Specialist Disability Accommodation (SDA).

Each component is tied to a support category (or group of support categories), and you can only use the funds for what’s allowed in that category.

You can’t move money between components, even if you underspend in one and need more in another. That’s why it’s important to know what’s included and plan your spending carefully.

💡 Ask your planner or support coordinator to give you a breakdown of what’s included in each component. If you’re self managed or plan managed, make sure your invoices are paid from the right support category. This can save you a lot of headaches down the track.

What Are Funding Periods?

A funding period is basically a set chunk of time during your plan when a portion of your funding becomes available. Instead of getting your full budget all at once, your funds are now released in stages, like instalments.

But here’s where it gets really confusing: not all supports will have the same funding period.

Here’s the typical funding periods you’re likely to see for different types of supports:

3 month funding periods will generally be the most common. It will be used for most supports like therapy, support workers, and community access.

1 month funding periods will likely be used for higher risk / high value or recurring supports, such as housing (eg. SIL, SDA, ILO), or plan management fees.

12 month funding periods may be used for things that are more predictable or need to be paid upfront, like assistive technology, home modifications, or bulk consumables.

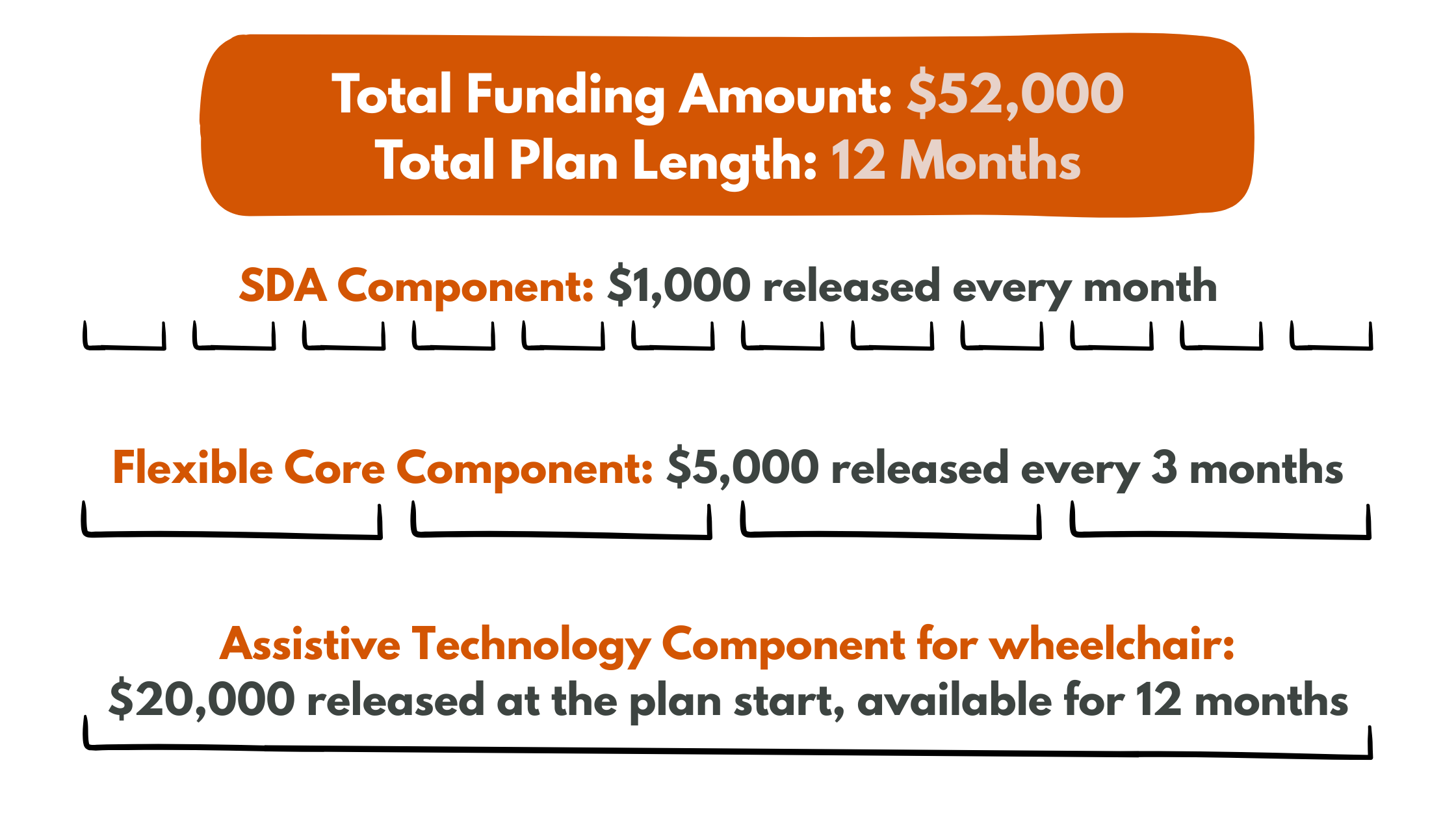

So yes, your plan might have a mix of all three. Your plan could look a bit like this:

[Image Description: Example plan split into smaller funding components and amounts.]

Your plan document will outline all the key details, but you can also log in to the my NDIS portal (through myGov) or the app to get a real time view of your funding.

There, you’ll be able to:

See your funding schedule, including when each funding period starts and ends.

Track your spending to view how much funding has been released, what’s been used, and what’s still available.

Understand your plan breakdown and see how your funding is split across different support categories.

How Does the NDIA Decide Your Funding Period Length?

The NDIA looks at a few things when deciding how long each funding period should be:

The total amount of funding in your plan

The type and cost of your supports

How often you need those supports

Your preferences (yes, you can have a say!)

Your past spending habits - have you overspent or underspent in previous plans?

Any risks, like financial vulnerability, fraud, or harm

If you think a different funding period would work better for you, you can talk to your planner or LAC about it. The NDIA will consider your request, especially if you can explain how it will help you manage your supports more effectively.

Here’s a few examples:

Want to bulk buy consumables like continence products? Ask for a 6 or 12 month funding period so you can stock up without worrying about running out of funds.

Prefer smaller, more manageable chunks to help with budgeting? You might benefit from 1 month periods.

Have a fluctuating condition and your support needs change month by month? A longer funding period might give you more flexibility.

You can also request changes if your situation changes during your plan, just be ready to explain why a different funding period would better support your new circumstances.

💡 If you’re requesting a different funding period, be specific. Explain how it will help you stay on track, avoid stress, or better meet your goals. The more clearly you can link it to your needs, the more likely it is to be approved.

What Happens If You Underspend or Overspend in a Funding Period?

Managing your NDIS budget has always been important, but with funding now split across periods there’s more to keep track of. Smaller chunks can make budgeting easier, but if one area goes off track, it can affect your whole plan faster.

So, what actually happens if you don’t use all your funding or if you use it up too quickly?

If You Don’t Spend All Your Funding (Underspending)

Let’s say you get to the end of a funding period and you haven’t used all the money allocated for that time. Good news: unspent funds roll over to the next funding period within the same plan.

This gives you a bit of flexibility. Maybe you had fewer appointments than expected, or a provider cancelled. Whatever the reason, that leftover funding will still be available in the next period.

But once your plan ends, any leftover funds do not carry over into your next plan. Each plan is treated as a fresh start, and the NDIA may look at your past spending when deciding how much to give you next time. So if you consistently underspend, they might assume you don’t need as much.

If You Use Up Your Funding Too Quickly (Overspending)

Now, what if you go the other way and spend your funding too fast?

This can happen for lots of reasons - maybe your needs changed, maybe you had unexpected costs, or maybe you just didn’t realise how fast it was going.

Here’s what happens:

You can’t access future funding early: If you run out of money in a funding period, you’ll need to wait until the next one starts to access more funds, unless the NDIA agrees to make an exception (which is rare and will usually only happen in emergencies).

You can’t “borrow” from other components: If you overspend in one funding component (like core supports), you can’t dip into another (like capacity building) to cover the gap. Each component is locked to its purpose.

You may need to request a plan reassessment: If you’re running out of funding because your needs have genuinely changed, you can ask the NDIA for a reassessment. Just be prepared to provide evidence, like updated reports or letters from your providers.

Top Tips To Prepare and Stay on Track

Let’s face it, this new way of managing your plan will take some getting used to. But the good news is there are some simple things you can do to stay organised, avoid surprises, and feel more confident using your plan. Here are a few practical steps to help you stay on track:

Check in with your Plan Manager: The NDIA’s tech upgrades have been major, and Plan Managers have had limited time to adjust. If you have a new plan starting soon, ask your Plan Manager how these changes might affect their service to you and their ability to pay invoices in a timely manner. It’s better to know ahead of time.

Track your budget regularly: Whether you’re using a dashboard from your Plan Manager or the my NDIS app, keeping an eye on your spending each month helps you stay on track and avoid surprises.

Talk to your support coordinator: If you have one, they’re a great resource for planning ahead, problem-solving, and making sure your supports are sustainable across the whole funding period.

Flag issues early: If you notice you’re spending too fast (or not at all) talk to your planner or LAC. It’s easier to adjust things early than to fix them later.

Know your plan details: Make sure you understand how long each funding period lasts, when the next one starts, and what’s included. If anything’s unclear, ask questions. You deserve to feel confident using your plan.

💡 Bonus: Login or sign up to Kinora for your free monthly budget check-in checklist - a simple guide to help you stay on top of it all.

You’ve Got This, (Plan) Period.

These changes to how your plan funding works are some of the biggest we’ve seen, and it’s okay if it all feels a bit overwhelming. With funding now released in stages and different supports on different timelines, there’s more to keep track of. But you’re not alone in this - your support team is learning too, and the goal is to keep your supports running smoothly.

The more you understand your plan, the more confident you’ll feel managing it. And if you ever get stuck, there’s help available.

Still have questions? In the Kinora community you can to connect with others, ask questions, and get support from people who get it. We’re here to help you make the most of your plan - every step of the way.